Dear fellow traders,

This was another option trade that I established using the Gartley Harmonic indicator of the Trade Scanner System.

I've noted down in my trading calendar that US gourmet restaurant operator Buffalo Wild Wings Inc. (BWLD) would be reporting earnings on 29/4/13 after market close.

I've taken a snap shot of the stock chart on 19/4/13 from Chart Trade Scanner when I could access it. You will realize that by then, the stock price has already surpassed the 200% Fibonacci level.

I determined that BWLD had to perform remarkably well in its upcoming earnings announcement if the stock price was to keep going up past this level. On the other hand, if BWLD reported marginal earnings figures, the stock price might be brought down to a more down-to-earth valuation price level.

Thus, I took the opportunity to sell a 90/95 bear call credit spread for a credit of $290 per contract on 18/4/13 just before the earnings announcement occurred after the US trading hours.

Though shares of Buffalo Wild Wings (BWLD) shot up more than 4% in Monday's (29/4/13) after-hours trading following a strong quarterly report from the company, the stock fell into a tailspin Tuesday (30/4/13) morning after a pair of analyst downgrades stemmed investors' excitement.

While Deutsche Bank raised BWLD price target from USD95 to USD105 from $95 per share, the US market drove shares of B-Wild down more than 4% after analysts at both Sterne Agee and KeyBanc downgraded the stock to "neutral" from "buy." In fact, the price of BWLD went down USD4 on 30/4/13 to end at around USD90.

I bought back the 90/95 bear call credit spread for USD168 for a profit of around USD120 (excluding commissions).

If you want to find out more about this Trade Scanner System, you can visit their web-site at : http://www.tradescannersystem.com/

You can also attend a preview session of this Trade Scanner System by contacting Tel : (65) 9011 8670 or email to : preview@TsMobile.com.sg

If you're from Indonesia, the contact info would be : Tel: (62) 21 2567 5922 / pertanyaan@TsLite.co.id

Yours Truly,

Tony Chai

ETP Batch #8

Automatic Forex Trading ETP System | Automated Forex Trading

The ETP automatic trading system is a automatic forex trading system that participants are able to adjust the criterias of the trading codes to adapt to the ever changing market conditions. The ETP Trading System is white box. The trading rules are all transparent to the attendees. We have the ability to change the trading criterias that we see fit according to the current market conditions. Use the discount code : 08009J to claim your S$250 discount while it is still available.

Saturday 4 May 2013

Saturday 20 April 2013

A Profitable Trade with ETP's Chart Trade Scanner

Hi fellow traders,

I was given the privilege to test run the chart trade scanner offered by ETP Trading System in Mar 2013.

On 5 March 2013, Mr Marcus Lau, Co-Founder of the ETP System, described some of the unique features/trade indicators of the chart trade scanner that can help traders make better trading decisions.

The chart trade scanner filters out stocks / commodities which match the particular criteria (trade indicators) determined by traders. This help to save tremendous amount of time for fellow traders to just zoom in on those specified trades that he or she wants to study further before trading.

I've particularly like the Gartley Harmonic indicator offered by the chart trade scanner. Marcus explained very comprehensively the origin about this particular trading indicator and its usefulness in helping a trader makes a trading decision.

As for me, I am interested to use the Gartley Harmonic indicator mainly to check the overbought, oversold, resistance or support Fibonacci level(s) determined by this indicator.

As I trade mainly US options, I set up a watch list of a few US stocks in the chart trade scanner and monitor their Gartley Harmonic indicator levels occasionally.

I've observed that the US stock IBM has been hovering around the 200% Fibonacci level just before it's earnings announcement on 18/4/13.

Thus, I took the opportunity to sell a 205/210 bear call credit spread for a credit of $280 per contract on 18/4/13 just before the earnings announcement which would occur after the US trading hours.

On 19/4/13, IBM plunged more than $15 when the company announced a rare miss on Wall Street forecasts on both revenues and profit. I collected the full credit of $274 on 19/4/13, after deducting the commissions.

Well, that's one way on how I have used the Gartley Harmonic indicator to trade US options. But I did use other trading tools too, to help me made this particular trading decision too.

If you want to find out more about this chart trade scanner, you can visit their web-site at : http://www.tradescannersystem.com/

You can also attend a preview session of this chart trade scanner by contacting Tel : (65) 9011 8670 or email to : preview@TsMobile.com.sg to find out more about the chart trade scanner.

If you're from Indonesia, the contact info would be : Tel: (62) 21 2567 5922 /

pertanyaan@TsLite.co.id

Yours Truly,

Tony Chai

ETP Batch #8

I was given the privilege to test run the chart trade scanner offered by ETP Trading System in Mar 2013.

On 5 March 2013, Mr Marcus Lau, Co-Founder of the ETP System, described some of the unique features/trade indicators of the chart trade scanner that can help traders make better trading decisions.

The chart trade scanner filters out stocks / commodities which match the particular criteria (trade indicators) determined by traders. This help to save tremendous amount of time for fellow traders to just zoom in on those specified trades that he or she wants to study further before trading.

I've particularly like the Gartley Harmonic indicator offered by the chart trade scanner. Marcus explained very comprehensively the origin about this particular trading indicator and its usefulness in helping a trader makes a trading decision.

As for me, I am interested to use the Gartley Harmonic indicator mainly to check the overbought, oversold, resistance or support Fibonacci level(s) determined by this indicator.

As I trade mainly US options, I set up a watch list of a few US stocks in the chart trade scanner and monitor their Gartley Harmonic indicator levels occasionally.

I've observed that the US stock IBM has been hovering around the 200% Fibonacci level just before it's earnings announcement on 18/4/13.

Thus, I took the opportunity to sell a 205/210 bear call credit spread for a credit of $280 per contract on 18/4/13 just before the earnings announcement which would occur after the US trading hours.

On 19/4/13, IBM plunged more than $15 when the company announced a rare miss on Wall Street forecasts on both revenues and profit. I collected the full credit of $274 on 19/4/13, after deducting the commissions.

Well, that's one way on how I have used the Gartley Harmonic indicator to trade US options. But I did use other trading tools too, to help me made this particular trading decision too.

If you want to find out more about this chart trade scanner, you can visit their web-site at : http://www.tradescannersystem.com/

You can also attend a preview session of this chart trade scanner by contacting Tel : (65) 9011 8670 or email to : preview@TsMobile.com.sg to find out more about the chart trade scanner.

If you're from Indonesia, the contact info would be : Tel: (62) 21 2567 5922 /

pertanyaan@TsLite.co.id

Yours Truly,

Tony Chai

ETP Batch #8

Monday 4 March 2013

ETP Auto-Trading - Recovery In Feb 2013

Saturday 16 February 2013

ETP Forex Auto Trading so far...

Dear fellow ETP Auto Traders,

I've been hit quite badly in January 2013 when a few of my 15 mins. Gold Sell trades reversed and I was stopped out with losses.

I adjusted the sell parameters of my ETP set file accordingly and was able to capture a profitable trade from the recent bearish Gold price movement :

Gold price has just broken one of the support line that I've drawn up. There are now 2 major support lines that I'm monitoring closely, namely : 1587 and 1544. These could be possible levels that Gold price might reverse.

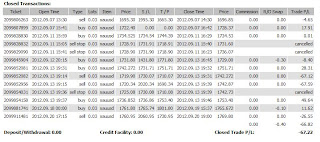

Here are my trading account statements for the past few months. After experiencing the consecutive losses in January 2013, I now stick to one trading account at AxiTrader where my set file parameters are performing well at the moment.

Wishing you good health and a prosperous forex trading year in 2013!

Yours Truly,

Tony Chai

I've been hit quite badly in January 2013 when a few of my 15 mins. Gold Sell trades reversed and I was stopped out with losses.

I adjusted the sell parameters of my ETP set file accordingly and was able to capture a profitable trade from the recent bearish Gold price movement :

Gold price has just broken one of the support line that I've drawn up. There are now 2 major support lines that I'm monitoring closely, namely : 1587 and 1544. These could be possible levels that Gold price might reverse.

Here are my trading account statements for the past few months. After experiencing the consecutive losses in January 2013, I now stick to one trading account at AxiTrader where my set file parameters are performing well at the moment.

Wishing you good health and a prosperous forex trading year in 2013!

Yours Truly,

Tony Chai

Saturday 3 November 2012

My ETP Auto-Trading so far

Dear fellow ETP Auto-Traders,

Yesterday evening I did not attend the DAT strategy live trading session. DAT trading strategy is a new ETP auto-trading strategy developed by Marcus/Jerome/Tin together with inputs from the strategy development team. It is basically a set and let it run strategy to capture big price movement during events, specifically the non-farm payroll report announcement on the 1st Friday of every month.

Although I didn't capture the downward gold price movement yesterday with my DAT strategy set file, my existing ETP 15 minutes gold strategy set file managed to capture this bearish gold price movement of about USD25.

I also hereby attached the screen capture of some of my account statements. As mentioned, I trade in small lots to constantly test the consistency of the parameters I set in the ETP auto-trading 15 minutes gold set file.

Yours Truly,

Tony Chai

Yesterday evening I did not attend the DAT strategy live trading session. DAT trading strategy is a new ETP auto-trading strategy developed by Marcus/Jerome/Tin together with inputs from the strategy development team. It is basically a set and let it run strategy to capture big price movement during events, specifically the non-farm payroll report announcement on the 1st Friday of every month.

Although I didn't capture the downward gold price movement yesterday with my DAT strategy set file, my existing ETP 15 minutes gold strategy set file managed to capture this bearish gold price movement of about USD25.

I also hereby attached the screen capture of some of my account statements. As mentioned, I trade in small lots to constantly test the consistency of the parameters I set in the ETP auto-trading 15 minutes gold set file.

Yours Truly,

Tony Chai

Sunday 19 August 2012

Statement of Account June & July 2012

Dear Fellow ETP-Auto Traders,

Here are my June & July 2012 accounts statements.

I'm testing very small lots on real trades to test the effectiveness of my ETP Auto-Trading parameters.

Recently the Gold prices have been trading in a channel, forming a wedge. I have amended my ETP parameters to adapt to the whip-saw movements in Gold prices. I don't enter the trade at every abrupt price spike. At the same time, I let the price has more room to move when a trade has been entered.

Regards,

Tony Chai

Here are my June & July 2012 accounts statements.

I'm testing very small lots on real trades to test the effectiveness of my ETP Auto-Trading parameters.

Recently the Gold prices have been trading in a channel, forming a wedge. I have amended my ETP parameters to adapt to the whip-saw movements in Gold prices. I don't enter the trade at every abrupt price spike. At the same time, I let the price has more room to move when a trade has been entered.

Regards,

Tony Chai

Friday 22 June 2012

Gold Price Down on 21 June 2012

Dear ETP Auto Traders,

Gold price was battered on Thursday after an industry survey indicated that manufacturing growth in June 2012 was at its slowest pace in 11 months. This slowed the hiring in the sector as overseas demand for the U.S. products weakened.

Gold price still below the 150 Day Moving Average (DMA) and touching support line price level of USD1,550.

Another commodity which took a hit was Crude Oil. Crude oil futures traded below USD80 per barrel for the first time since October 2011 after a number of weak U.S. data added to concerns over the economic recovery of the world’s largest economy.

China's dismal manufacturing data and the euro zone crisis further dampened the appeal of growth-linked assets.

Yours Truly,

Tony Chai

Gold price was battered on Thursday after an industry survey indicated that manufacturing growth in June 2012 was at its slowest pace in 11 months. This slowed the hiring in the sector as overseas demand for the U.S. products weakened.

Gold price still below the 150 Day Moving Average (DMA) and touching support line price level of USD1,550.

Another commodity which took a hit was Crude Oil. Crude oil futures traded below USD80 per barrel for the first time since October 2011 after a number of weak U.S. data added to concerns over the economic recovery of the world’s largest economy.

China's dismal manufacturing data and the euro zone crisis further dampened the appeal of growth-linked assets.

Yours Truly,

Tony Chai

Subscribe to:

Posts (Atom)